While the Union Budget of India focuses largely on tax changes and planned expenditures, it also provides insight into current Federal Government actions. Market participants can now view real-time developments as they happen on Budget Day with stocks trading still open - this change has turned Budget Day from simply an after-speech reaction into an opportunity for market participants to assess their confidence level in all three Markets (Equity, Bond and the Indian Rupee).

Why is this important? The announcement of the Budget coincides with an increasingly fragile period for the economy: constant but still weak growth rates; continuing inflationary pressures that are yet to be totally eliminated; volatility in international capital flows based upon changes in US interest rates. Now that stocks are trading during the live event of the Budget announcement, market reactions to the announcement are immediate, volatile, and even more indicative than before when you received closing numbers.

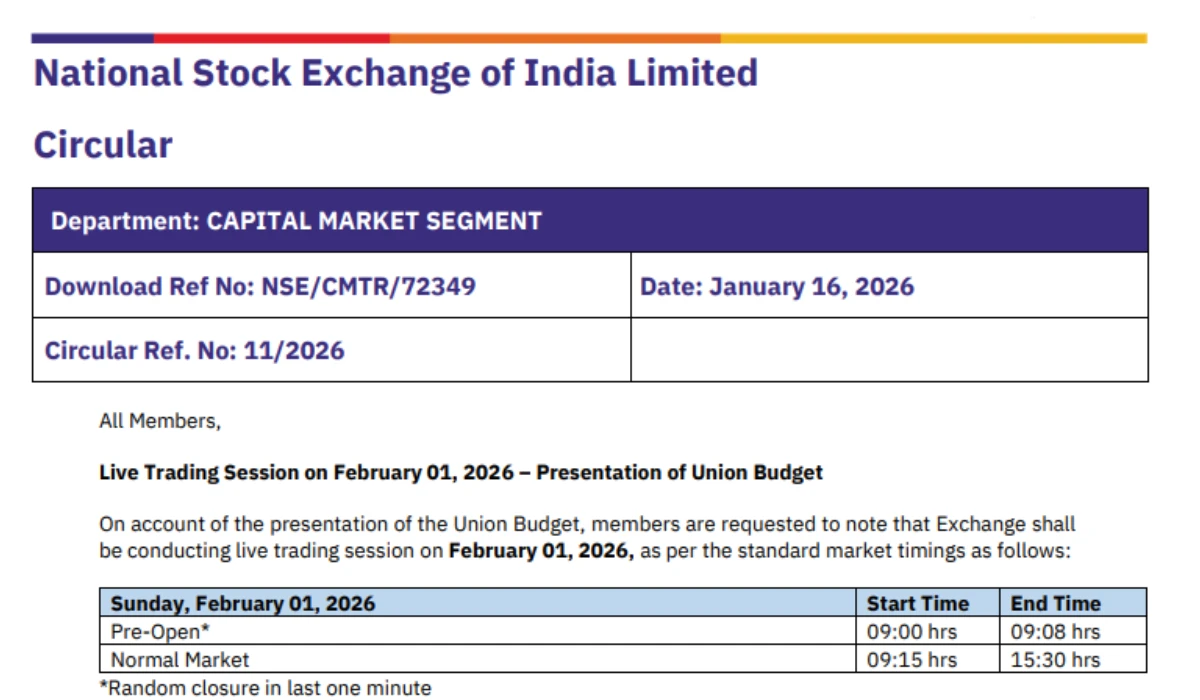

A different Budget Day on Dalal Street

Traditionally, Budget Day trading was either halted or highly muted, giving investors time to digest announcements. This time, trading continued as the finance minister outlined priorities, allowing prices to move alongside policy cues. Banks, infrastructure stocks, consumption-linked companies, and exporters all responded within minutes.

This live setting reduced speculation and forced clarity. When announcements leaned toward fiscal discipline, government bond yields steadied instead of spiking. When growth spending was emphasised, capital goods and construction-linked stocks saw immediate interest. The market’s message was visible instantly, not hours later.

Fiscal balance and growth signals move together

One of the strongest undercurrents during the session was the balance between spending and restraint. Investors looked for reassurance that the government would continue narrowing the fiscal deficit without choking off growth. Even modest signals of discipline helped calm bond markets, which had been wary of higher borrowing.

At the same time, allocations linked to infrastructure, manufacturing incentives, and employment-generation schemes supported equity sentiment. The combination suggested continuity rather than a policy shock, a factor that kept volatility in check despite active trading.

The rupee’s quiet role in the background

Currency traders also watched closely. The rupee has been under pressure from global factors, especially uncertainty around US Federal Reserve policy. A Budget that signals stable borrowing and predictable spending tends to support the currency indirectly by reassuring foreign investors.

During live trading, the absence of aggressive new populist measures helped prevent sudden weakness. While the rupee did not strengthen sharply, it avoided the sharp swings that sometimes follow policy-heavy days, reflecting cautious confidence rather than enthusiasm.

Sectors reading between the lines

Not all reactions were dramatic, but sector-level movements told a story. Banking stocks tracked expectations around credit growth and government borrowing. Consumer-facing companies moved in response to tax stability signals, which implied steady household demand rather than a sudden boost or squeeze.

Export-oriented firms were more influenced by global cues than domestic policy, highlighting that India’s market narrative now blends local budgets with international conditions more tightly than before.

A calmer, more transparent reaction cycle

Keeping markets open also reduced the gap between announcement and understanding. Instead of waiting for expert interpretations, investors saw collective judgment form on screens. This transparency helped retail investors follow sentiment more clearly, especially those trading through mobile apps who often react to headlines without context.

Short-term traders found opportunities in volatility, while long-term investors focused on whether the Budget reinforced India’s medium-term growth story. The absence of panic selling suggested trust in policy continuity rather than surprise-driven fear.

Conclusion

As the session progressed, one theme became clear: markets prefer predictability over dramatic gestures. By allowing trading to continue, policymakers effectively invited judgment in real time. The result was not chaos, but a measured response shaped by fundamentals.

This approach may set a precedent. If future Budgets also unfold during open trading, investors could benefit from quicker price discovery and fewer rumor-driven swings. For policymakers, the feedback loop becomes faster and harder to ignore.