Nvidia has officially become the first publicly traded company in the world to reach a $4 trillion market valuation. This remarkable milestone took place on July 9, 2025, when Nvidia's share price jumped to an all-time high of $164.42 during intraday trading. Although it closed slightly lower, the company still ended the day with a valuation of nearly $3.97 trillion—well above its closest competitors.

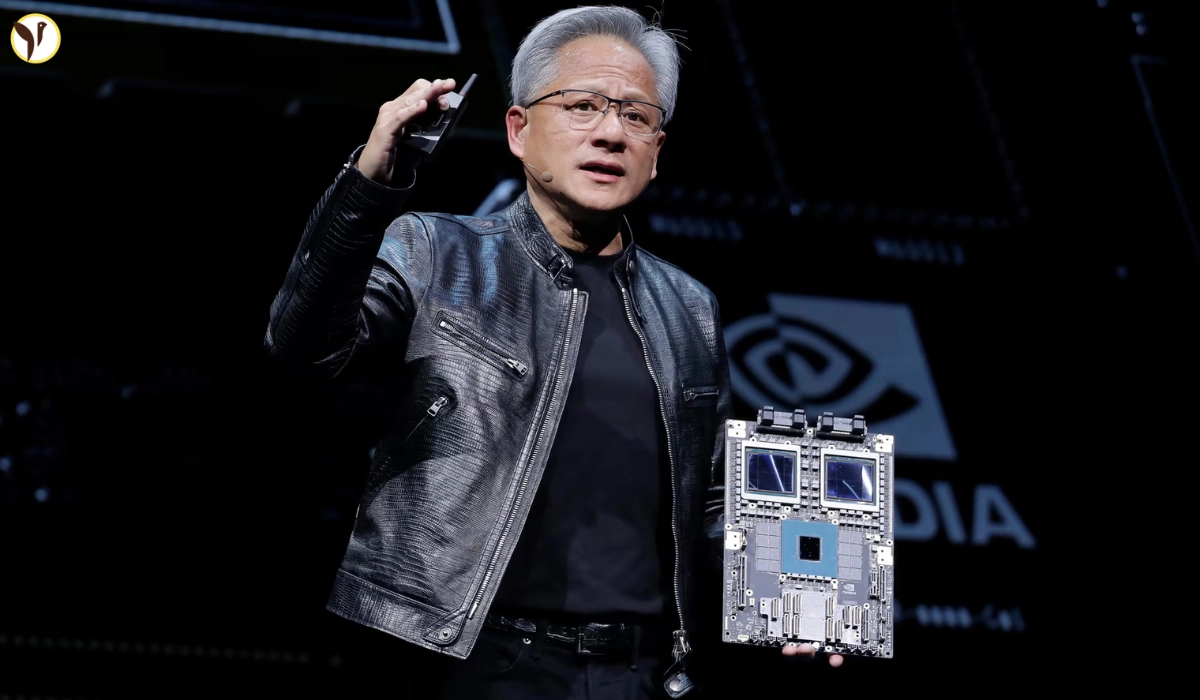

This achievement highlights Nvidia’s central role in the booming artificial intelligence (AI) industry. The company’s high-performance chips are the backbone of most major AI systems, powering everything from large language models to advanced robotics. Major tech firms like Microsoft, Meta, Google, and Amazon rely heavily on Nvidia’s chips to run their AI infrastructure.

Nvidia’s journey to the top has been nothing short of extraordinary. Just a few years ago, it was primarily known for its graphics cards used in gaming. But with the rise of AI and machine learning, Nvidia transitioned into a powerhouse for data centers and cloud computing. Over the past year alone, its stock has more than tripled, driven by rising chip sales and record-breaking earnings.

The $4 trillion mark puts Nvidia ahead of both Microsoft and Apple, which were long considered untouchable in terms of market dominance. Microsoft now holds second place with around $3.7 trillion in valuation, followed closely by Apple.

JUST IN: Nvidia officially hits a $4 trillion market cap. pic.twitter.com/5Ai6Z1wQhc

— Brew Markets (@brewmarkets) July 9, 2025

What This Means for the Market and the Future of AI

Nvidia’s rise reflects more than just a strong business model—it signals a major shift in the global economy. For decades, oil companies and smartphone giants dominated the top of the market. Now, a chipmaker focused on artificial intelligence is leading the way.

This development also reshapes the S&P 500 index. Nvidia now makes up about 7.3% of the index, more than any other single company. Its market cap is even larger than the entire stock markets of some major economies, including Canada, Mexico, and the UK.

The company’s performance has also lifted investor confidence across the technology sector. On the same day that Nvidia crossed the $4 trillion mark, its stock closed nearly 2% higher, showing strong momentum and optimism about its future.

Still, experts caution that the road ahead won’t be without challenges. With such high expectations, Nvidia must continue to innovate and maintain its lead in AI hardware. Rivals like AMD and in-house AI chip programs at big tech firms could bring serious competition in the coming years.

But for now, Nvidia’s $4 trillion moment is a landmark in financial and technological history. It marks the beginning of a new era—one where AI is not just a buzzword, but the engine driving the world’s most valuable company.

Nvidia notched a market capitalization of $4 trillion, making it the first public company in the world to reach the milestone and solidifying its position as one of Wall Street's most-favored stocks. Read: https://t.co/WWpK67vc4Y pic.twitter.com/etDDwZrNoH

— Reuters Business (@ReutersBiz) July 9, 2025