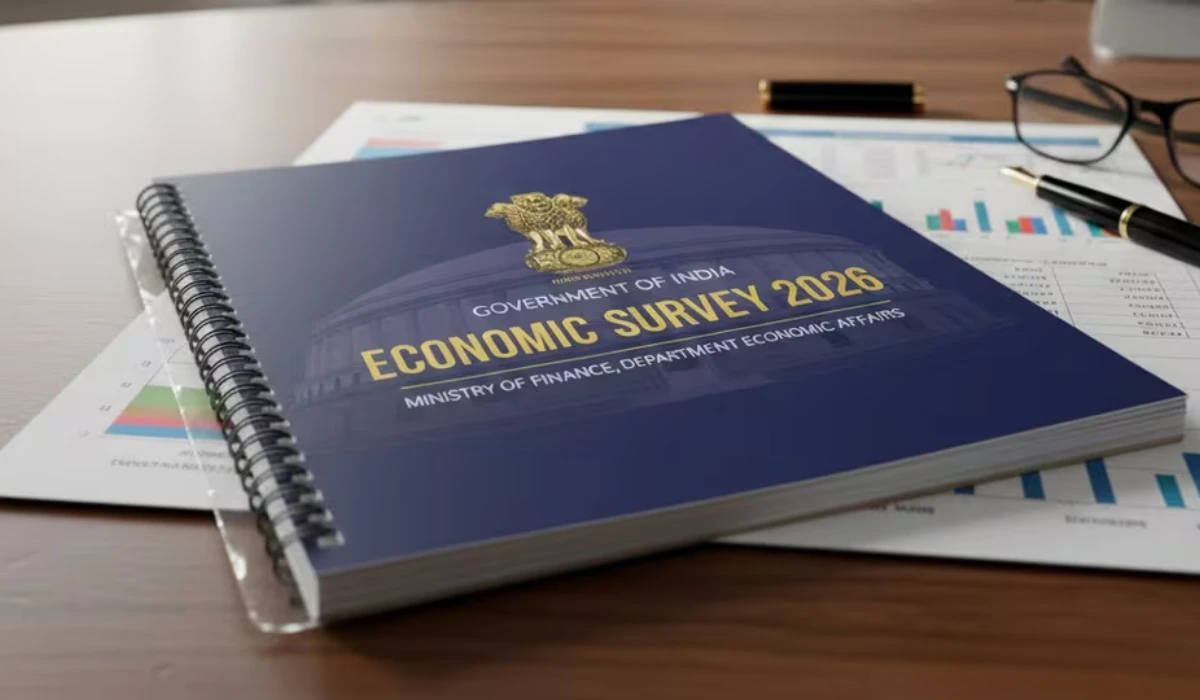

New Delhi, January 29, 2026 —India’s Economic Survey 2026, tabled in Parliament today ahead of the Union Budget 2026-27, paints a picture of strong domestic demand, stable macroeconomic fundamentals, and forward-looking reforms that are expected to shape India’s economic journey in the coming years.

What is UGC 2026

UGC 2026 isn't a specific thing on its own—it's likely a mix-up from recent buzz around India's Economic Survey 2025-26, released January 28, 2026, which folks sometimes tag with "UGC" by mistake since UGC (University Grants Commission) handles education funding and ties into economic talks on jobs and skills. No separate "UGC Economic Survey 2026" exists; the big news is the government's full Economic Survey 2025-26, a yearly report card on India's money matters, tabled in Parliament by Finance Minister Nirmala Sitharaman.

This survey looks back at FY25 (April 2024-March 2025) and ahead to FY26, showing India as the fastest-growing big economy with steady wins in growth, prices, and jobs. It's not from UGC directly but reviews education's role in the economy, like training youth for AI-era work. As of January 29, 2026, it's the hottest economic read, guiding the upcoming Union Budget.

Steady Growth Outlook: India’s GDP on the Rise

The Economic Survey projects that India will grow at 7.4% in FY26, reaffirming its status as the world’s fastest-growing major economy.

For the next financial year (FY27), growth is forecast at 6.8–7.2%, driven by robust domestic demand, increased investment, and sustained fiscal discipline.

Key Growth Indicators:

- Real GDP growth: ~7.4% in FY26.

- Projected FY27 GDP: 6.8% to 7.2%.

- Private consumption remains a major engine of growth.

This strong growth outlook reflects India’s resilience amid global economic uncertainties like geopolitical tension, tariff barriers, and weaker exports.

Domestic Demand and Investment: The Core Growth Engine

One of the major messages of the survey is that India’s growth is driven from within — not just external markets.

Domestic Demand Highlights:

- Households are spending more, boosting private consumption significantly.

- Private Final Consumption Expenditure has climbed to its highest share in years, supporting steady expansion.

- Gross fixed capital formation — a measure of investment — continues to be strong.

This domestic engine has helped cushion external shocks and reinforces the long-term sustainability of India’s economic growth.

Inflation and Monetary Stability: A Controlled Path Ahead

The Survey finds that inflation has largely remained within comfort levels, giving consumers room to spend and businesses room to invest.

Experts expect inflation to gradually align with the Reserve Bank of India’s target range in the coming year, helping preserve purchasing power without stalling economic activity.

Fiscal Discipline and Budget Context

The Economic Survey sets the stage for the Union Budget by offering a comprehensive look at government revenues, expenditure patterns, and deficit management.

- The fiscal deficit is narrowing, signalling continued fiscal discipline.

- Government revenue and GST collections have improved, supporting growth priorities.

This context helps explain why the Budget 2026-27 is expected to balance growth-oriented spending with fiscal prudence.

Exports, Trade Deals and External Challenges

Despite strong internal fundamentals, the survey acknowledges ongoing global headwinds:

- Global volatility, trade barriers, and geopolitical disruption remain external risks.

- A potential India-US trade agreement could ease export uncertainty once sealed.

- Precious metals like gold and silver saw elevated demand due to global risk sentiment.

The report underscores that diversification of export markets and deeper trade integration will be strategic priorities.

AI, Innovation and Future-Ready Growth

A standout focus of the Survey is strategic use of technology, especially Artificial Intelligence (AI).

Instead of chasing global prestige models, the document calls for AI systems tailored to India’s specific needs — such as agriculture analytics, healthcare diagnostics, classroom learning tools, and water management.

This practical approach aims to:

- Boost productivity in core sectors.

- Lower structural inefficiencies.

- Enhance service delivery across states.

Education: Human Capital and Long-Term Development

Education — a critical pillar for sustained economic progress — figures prominently in the Survey’s analysis.

Education Sector Progress:

- Gross Enrollment Ratios have increased at both primary and higher levels.

- Growth of premier institutes like IITs, IIMs and expanded vocational pathways.

- Education remains central to developing skilled human capital for India’s future.

Despite progress, the Survey calls for continued focus on upskilling, quality enhancement, and equity in opportunity.

Risks and Outlook: Preparing for Global Uncertainties

The Economic Survey also outlines possible future risks and scenarios for 2026 and beyond:

- Continued geopolitical fragmentation.

- Shock-linked disruptions caused by financial linkages.

- Sectoral challenges, including export slowdowns and capital moderation.

By mapping these potential outcomes, the Survey pushes for strategic resilience and structural readiness, rather than short-term fixes.

Economic Survey 2026 is finally here.

— Yooki (@yooki_selflearn) January 29, 2026

These are the core areas you should track for Prelims and Mains, straight from the Survey.#EconomicSurvey #UPSC #UPSCPrelims2026 pic.twitter.com/rZ65hkLvfu

What This Means for India’s Economic Future

The Economic Survey 2026 tells a clear story: India’s growth is not accidental but built on strong domestic fundamentals, reform momentum, and long-term strategic planning.

Key takeaways:

- India’s GDP growth remains strong (7.4% in FY26).

- Future growth is expected at 6.8–7.2%.

- Domestic demand and investment are the backbone.

- Inflation is under control, supporting consumption.

- AI strategy and education reforms point to future readiness.

These insights will shape India’s economic policies, investment flows, and global positioning well into the decade ahead.

New GDP Makeover Coming February 2026: Truer Picture

Big news under the hood – India's growth numbers get a fresh coat in Feb 2026. New base year reflects post-virus world: Digital shops, gig work, GST data for spot-on counts.

Old ways missed online booms; new ones use EPFO jobs, corporate files for accuracy. Inflation tracking updates too, with e-commerce prices. Result? Investors cheer a sharper India story, maybe even higher ratings.

This reset syncs with labor fixes and global payment links, making 2026 a pivot year.

OTHER ARTICLES TO READ:

- Akriti Negi Breaks Silence on Her Breakup: Here’s What She Said ?

- Storm Chandra Triggers Flood Emergency, Schools Shut Across UK

- What Went Wrong Between Bigg Boss 19’s Abhishek and Pranit?

- Is Aryan Khan Show Now Legally Safe After Sameer Wankhede Case?

- Baby Name Revealed: Bharti Singh Shares Special Family Moments

- When Is the IND vs NZ T20 Finale: Key Players, Venue & Series Update

- Is Your WhatsApp Account Really Safe After the New Security Update?

- What Went Wrong With Melania Trump’s Documentary Release?

- Beauty 2 The Streetz Founder Shirley Raines Dies Suddenly: What Really Happened?

- Who Is Jacorey Bynum and How His Viral Game Against Carlsen?