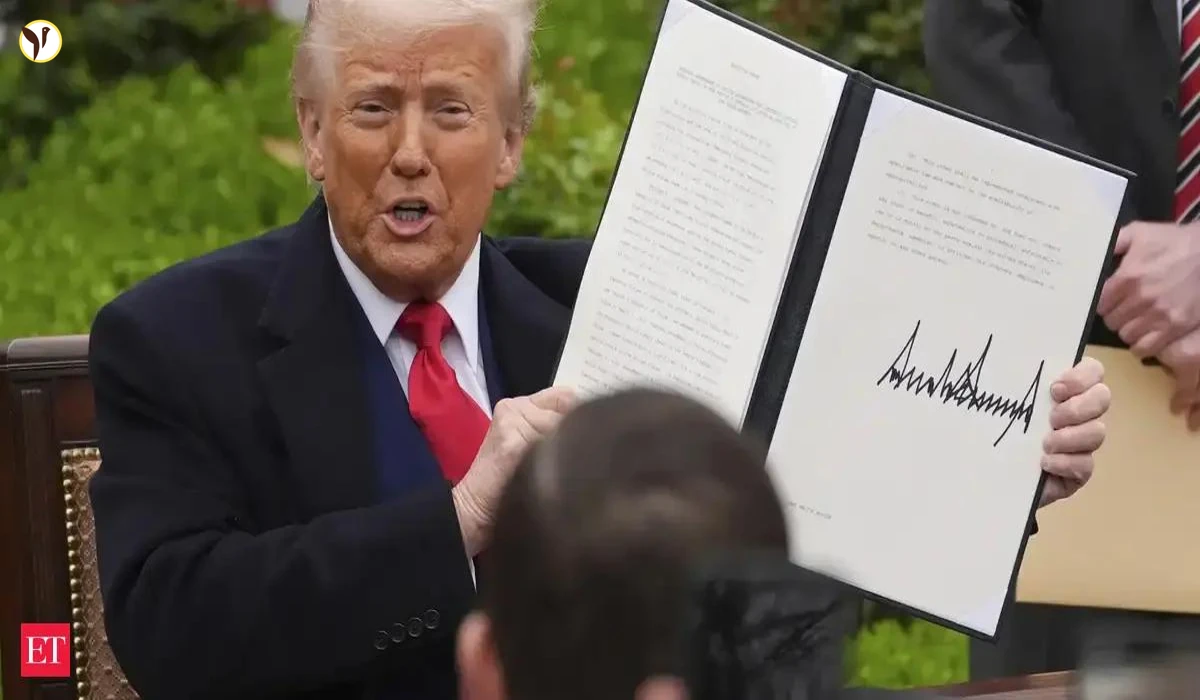

Trump's "TACO Trade": Is He Really Chickening Out?

Honestly, the drama surrounding President Trump's trade policies is enough to give anyone whiplash. The latest chapter? A catchy new nickname making the rounds on Wall Street: the "TACO trade," which, for those not in the know, stands for "Trump Always Chickens Out." This refers to Trump's pattern of announcing huge tariffs, only to backpedal or delay them shortly after.

The "TACO" Takes Shape

It all started with a Financial Times columnist, Robert Armstrong, who apparently noticed a pattern. Trump's tough talk on tariffs sends markets plummeting, but then, when he softens his stance (or just delays the implementation), markets rebound. It's become predictable enough that some investors are actually betting on this cycle – buying low after a tariff threat, expecting a quick recovery. I mean, it's crazy but seems to be working, at least for some.

This isn't just about the recent 50% tariff threat against the European Union, which was delayed until July 9 after a call with EU President Von der Leyen. There have been similar instances, like the April "reciprocal" tariffs which got reduced after causing a major market dip. So, to many, "TACO" isn't just a joke; it feels more like a strategy now.

Trump's Response: "Nasty Question!"

When a reporter brought up the "TACO trade" during a recent press briefing, President Trump’s response was... spirited. He called the question "nasty," insisted the nickname was new to him (which, let's be honest, is highly debatable), and vehemently denied "chickening out." He argued that the delays and adjustments are all part of his brilliant negotiation strategy. He even said things like, "Six months ago this country was stone cold dead, people didn't think it would survive." I guess you could say he's using the heat from the crisis as his negotiation tool.

- Key points from Trump's rebuttal: The delays are about negotiation, not backing down; his economic policies are a success, and the "TACO trade" is just a nasty accusation.

Market Reactions and Investor Sentiment

The market reactions to Trump's tariff pronouncements have become somewhat predictable. A sudden threat causes a short-term dip, followed by a rally when things get softened. But that predictability brings its own set of anxieties. Some investors are wary of the uncertainty, saying it's hard to make sound decisions based on such constantly shifting policies. One analyst I read even said it's damaging investor confidence in the US in the long term. It's definitely a complicated situation.

Conclusion: The TACO Trade's Future

The "TACO trade" is more than just a catchy acronym; it reflects a real pattern in Trump's trade approach. Whether this pattern will continue or investors will soon find the strategy exhausted remains to be seen. What's clear is that the unpredictability of Trump's tariff threats continues to create ripples throughout the financial world.

Stay tuned for further updates on this ongoing economic saga. Will the "TACO trade" become an established part of market analysis? Or will this pattern break and surprise everyone?