Millions of taxpayers are still waiting for their 2025 IRS refunds as delays stretch far beyond normal timelines. With some refunds still not processed in June, those expecting stimulus cash or Education Credit reimbursement must act now to avoid additional setbacks.

What’s Happening

-

Accepted returns are typically refunded in 10 to 21 days for e-filers with direct deposit. Paper returns and amended filings may take 4 to 8 weeks—or longer.

-

As of June 2025, processing bottlenecks are driven by:

-

Backlogs from early 2025 filings

-

Heightened identity verification checks

-

Staff shortages and tech system updates at IRS

-

-

IRS staffing cuts affecting 7,000+ employees may exacerbate delays into late summer and beyond.

Who Is Most Affected?

- This applies to paper filers, especially those who filed their returns through the mail.

- This action applies to people who claimed Earned Income Tax Credit (EITC) or Child Tax Credit (CTC)....the refunds for those credits tend to be later (often, March).

- This action applies to taxpayers whom the IRS has flagged for identity differences, SSN issues, or manual review.

- This action applies to taxpayers who have changed their mailing address or bank account information since filing their tax return.

What You Should Do Next

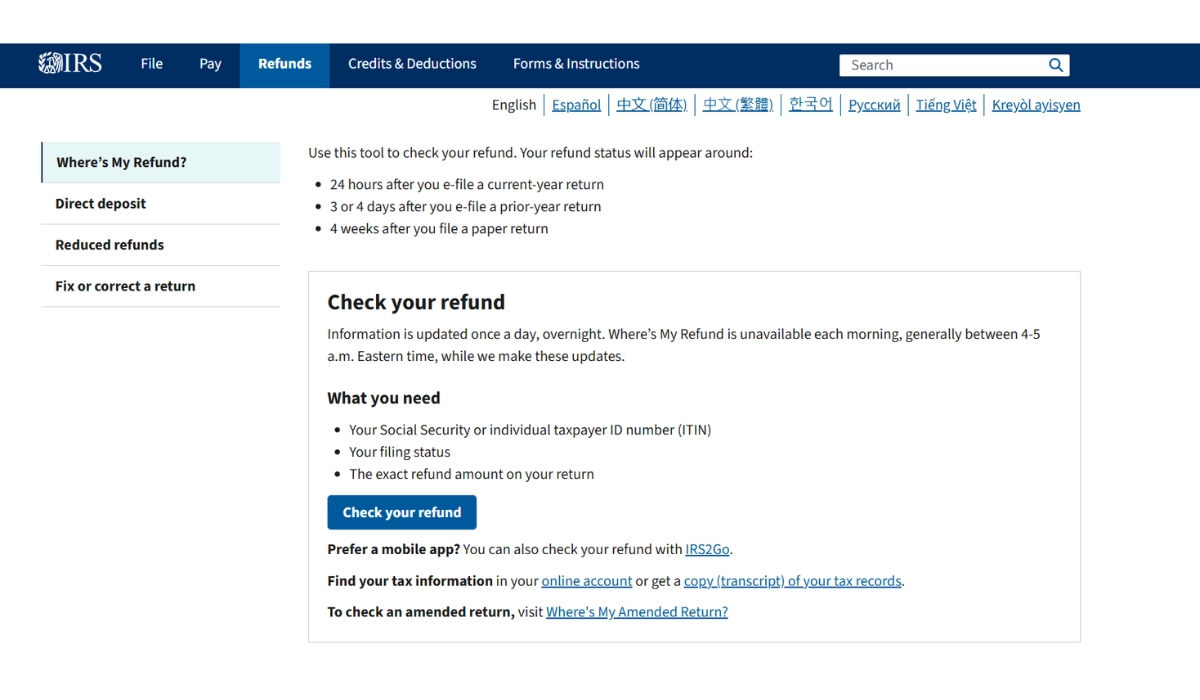

- Check your refund status using IRS's "Where's My Refund?" tool or the IRS 2GO mobile app. All you need is your SSN, filing status, and refund amount to check your status.

- Wait at least 21 days if you filed using e-file and at least 6 weeks if you filed a paper return before calling the IRS for status.

- If you call the IRS, use the "1-2-3 hack" to connect more quickly to a live IRS representative (press 1 for English, then 2, and last, 3). This process can help you decrease your hold time to ~60 sec.

- Do not re-file or submit a second return unless the IRS specifically tells you to.

- Move to direct deposit only: paper checks will be obsolete, as the IRS will stop issuing paper checks altogether by September 2025.

Final Takeaway

If your refund is delayed, it's not just you—IRS processing is slower due to backlog, staffing cuts, and verification checks. Use the official tools, call only after waiting the recommended time, and switch to direct deposit to ensure faster, secure refunds.