Mahindra Demerger: India’s leading auto and tractor maker, Mahindra and Mahindra (M & M) is reportedly working on restructuring and separating their tractor and SUV units and possibly their trucks into individual companies similar to Tata motors demerger.

Mahindra Demerger Plans

Mahindra group is looking into strategies to streamline and improve operations and strength within its core branches comparatively to its main competitors. Although, this idea of Mahindra Demerger is still waiting approval, and is expected to focus and improve their operations, it is ultimately to increase the value of their business to their shareholders. Currently, automotives cover about 65% of Mahindra’s overall market value while the tractors keep leading the market with 43% of market share.

Mahindra Sales Growth: Tractors and SUVs Lead the Way

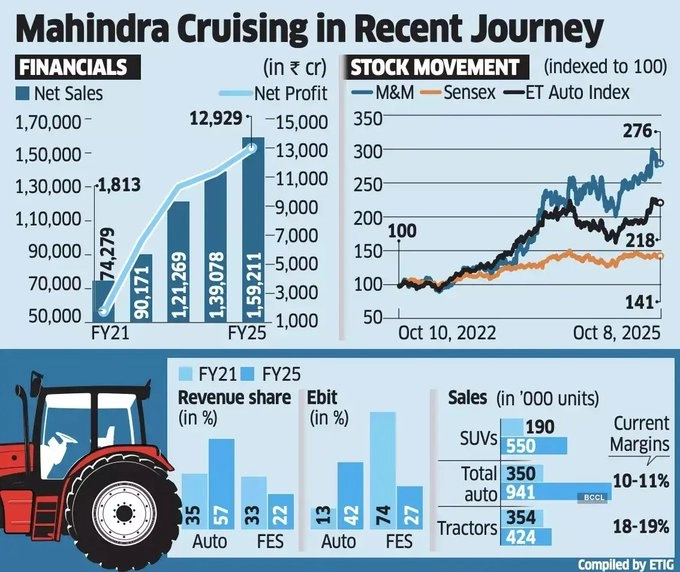

In the last five years Mahindra has had notable increase in key sectors.

- The sales of Mahindra SUVs increased from 190,000 in FY21 to an estimated 550,000 in FY25.

- In FY25, the tractors department alone sold 424,000 tractors which was an overall market share of 43.3% and represented a 19.7% increase since FY21.

- Mahindra's total net profit increased from ₹1,812 crore in FY21 to more than ₹13,000 crore in FY25, while revenues nearly doubled to ₹1.56 lakh crore.

Mahindra and Mahindra’s Big Move? Value Unlocking on the Horizon!

— Parimal Ade (@AdeParimal) October 9, 2025

Mahindra Group is reportedly weighing a major restructuring — spinning off its tractor, passenger vehicle (PV + EV), and truck divisions into separate entities.

Why it matters

•Auto dominates: 65% of M&M’s…

What Could Change After the Mahindra Demerger?

If the demerger happens:

-

Each division—tractors, SUVs, trucks—could become a standalone company with separate management and business goals.

-

SML Isuzu (recently acquired by Mahindra) could anchor the new commercial vehicle business.

-

Investors could see clearer capital allocation and possibly higher market valuations, as happened following Tata Motors’ split.

Key Motives Behind Mahindra's Restructuring

-

Reduce dependence on farm sector cycles by strengthening auto and commercial vehicle divisions.

-

Hugely successful models like Scorpio, Thar, and XUV drive Mahindra’s auto business, while the tractor arm benefits from solid market leadership.

-

Past demerger ideas were paused due to fears of losing synergy and sourcing strength, but now the divisions already operate with independent teams.

image credit: economic times

Mahindra Demerger Market Impact: What Experts & Analysts Think

-

Analysts suggest a demerger would help sharpen strategy and make Mahindra more agile in facing global economic shifts.

-

Tractors could become an even bigger focus, given record growth and agricultural demand.

-

Auto and truck units might attract new investors and partnerships for electric and commercial vehicles.

Disclaimer: The information in this article is meant for informational purposes only. Jobaaj.com does not offer investment advice. Investors are advised to conduct their own due diligence and consult certified financial experts before making investment decisions.