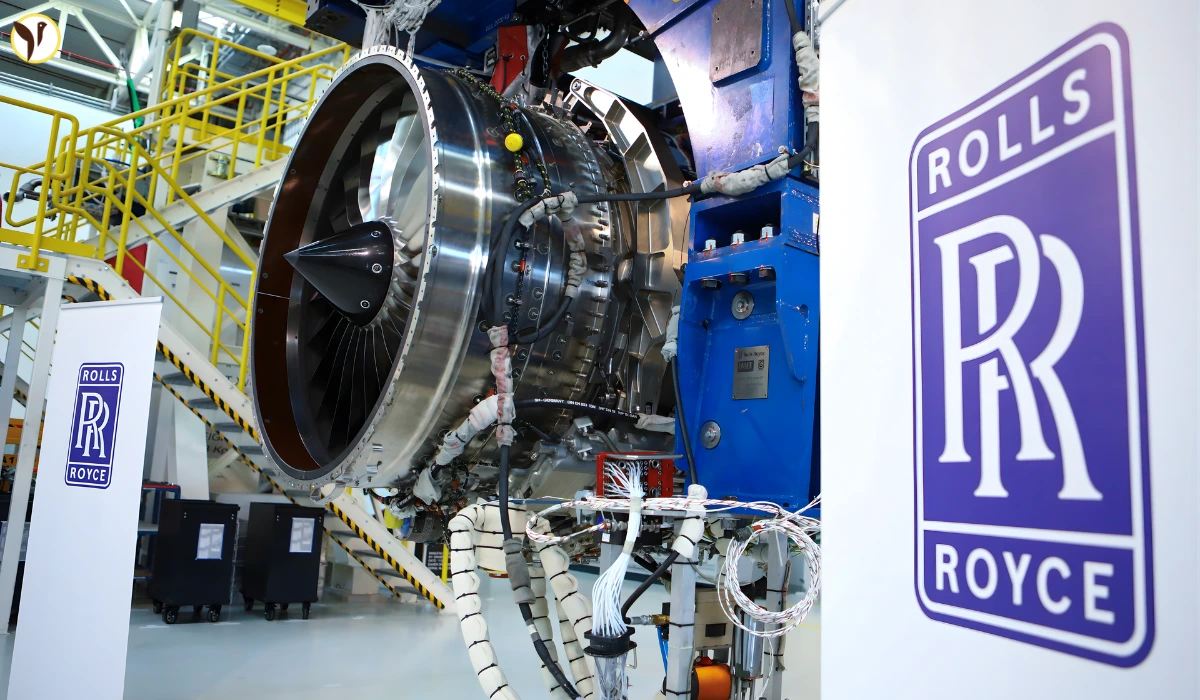

Rolls-Royce’s share price is showing a small dip today, hovering around 1149p, down about 0.3%. But don’t let this fool you—behind the scenes, the company is shining bright with strong orders for jet engines. The firm recently updated investors about its solid outlook for 2025, thanks mainly to a busy order book and growing demand in aviation. This confidence from Rolls-Royce is making investors hopeful about what’s ahead, even if the stock price is a bit shaky now.

Why Are Jet Engine Orders So Important for Rolls-Royce?

Jet engine sales are a huge deal for Rolls-Royce because they drive most of the company’s revenue. In 2025, the firm has seen more orders than expected, especially from airlines needing more efficient and advanced engines. These new orders mean steady income and help Rolls-Royce keep growing despite the ups and downs of the global economy. A strong order book is like a promise of good business in the future, and it’s one of the key reasons Rolls-Royce feels confident about profits this year.

What’s Happening with Rolls-Royce’s Share Price?

Though the shares slipped a little today, experts say this kind of small movement is normal, especially amid wider market swings. The stock has actually done really well this year, rising nearly 95%, which is huge for a big aerospace company. Some investors see dips like this as a chance to buy shares at a better price. Overall, the outlook remains positive because Rolls-Royce’s core business is strong, and the company is investing wisely in new technologies.

We’ve published our trading update, with a strong performance across the Group, driven by our actions and strategic initiatives, in line with our expectations. This builds further confidence in our financial guidance for the full year: https://t.co/65IDYhGaoy pic.twitter.com/HUArkWmmMH

— Rolls-Royce (@RollsRoyce) November 13, 2025

How Is Rolls-Royce Performing Financially?

Rolls-Royce reports solid cash flow and good control on costs, which helps them turn all those engine orders into profits. The company confirmed it still expects to meet its profit goals for 2025. This steady financial health means Rolls-Royce is a major player in the aviation industry and stock market. The firm’s management is optimistic that their plans for sustainable tech and innovation will keep them competitive for years to come.

Rolls-Royce Quick Facts and Share Price Data (November 2025)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What Do Investors Think?

Many investors feel positive looking at Rolls-Royce’s strong orders and profit projections. They appreciate the company’s focus on future technology, including greener aviation engines. Some say it’s a story of patience and long-term growth. While small bumps in the stock price happen, Rolls-Royce’s position in the market and its plan to innovate keep investors excited about what comes next.

Conclusion

Rolls-Royce’s share price may have a little wobble now, but the company’s strong jet engine orders and solid profit outlook show a bright future. With smart management and a clear focus on growth and tech, Rolls-Royce is well set for the years ahead. For anyone interested in aerospace or steady investing, Rolls-Royce is one to watch carefully.