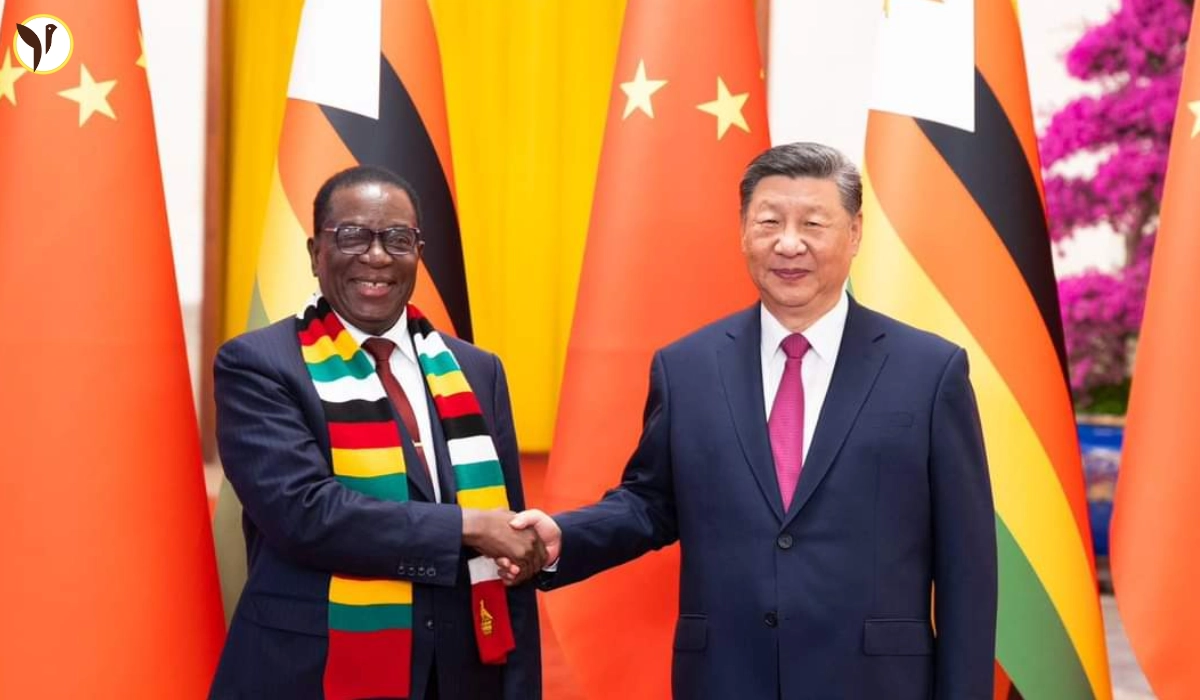

Global Raw Materials and Energy Strategy: Zimbabwe and China Lead the Shift

In the rapidly changing landscape of global raw materials and energy markets, two powerful stories form economic strategy and Zimbabwe's courageous attitude in lithium, and China's new dominance in liquid gas (LNG). These developments not only reflect the internal ambitions of countries, but also show greater changes in global supply chains, energy security and resource sovereignty.

Zimbabwe’s Lithium Vision: Moving Up the Value Chain

Zimbabwe is blessed with one of the world's largest lithium reserves and attempts to rewrite its economic history by ensuring that it removes its maximum value from its natural resources. Lithium, an important mineral used in electric vehicles and batteries in clean energy technology, has seen an increase in demand in recent years. However, the Zimbabwean government is no longer satisfied with the export of raw lithium ore. Instead, mining companies have established local refineries and charities for processing and refineries that allow the country to export products at higher values and develop domestic manufacturing skills. The intention is clear. If you move the value chain, create jobs, maintain more income within the country, and reduce your reliance on foreign processing facilities.

Challenges in Implementing Local Beneficiation

This strategic step did not come without complications. Many mining companies, including Chinese investors who control Zimbabwe's lithium sector, are concerned about the immediate enforcement of these advantage requirements. Given the global lithium prices, which recorded a high decline after the climax during the EV boom, profit margins are boosted, and companies argue that the additional costs and time required to develop refineries may not make profits in a short period of time. Furthermore, Zimbabwe lacks sufficient infrastructure to support rapid industrialization of this scale, including reliable electricity, water supply and logistics networks. Mining companies are asking for more time to comply with the government to delay export taxes on unprocessed lithium before local refineries are in operation. While governments are defined by their long-term vision, they say negotiations with stakeholders will find an intermediate foundation that protects both national interests and business continuity. This balancing law highlights the difficulties exposed to many resources.

China’s Strategic Moves in the LNG Market

Energy requirements make China deeply entangled in global trade and industry growth. When global LNG prices rose over the past few years due to the energy crisis and geopolitical tensions, Chinese importers reduced their purchases and sold some of their packages. But now prices have fallen and the market is stable, so Chinese LNG dealers are once again in courageous moves. They actively return to the spot market, buy in bulk at large prices, effectively position themselves as potential reschoolers in the LNG value chain. This flexibility not only helps China to ensure energy security to its own needs, but also provides a geopolitical lever as it can affect the availability of care availability in other countries, particularly in Europe and Asia.

Navigating Tariffs and Expanding Global Partnerships

With new tariffs being imposed on US LNG, Chinese dealers want to exchange fees or redirect fees to avoid financial penalties. They diversify LNG sources, create new trade routes, and build long-term partnerships in Africa, the Middle East and Southeast Asia to reduce their dependence on a single supplier. This operation shows that China is not only a passive consumer in the global energy market, but also a powerful orchestrator who can make the global energy flow into your profits.

The Emerging Era of Strategic Resource Control

The development of these twins in Zimbabwe calls for symbols of a new era in which resource management, national interests and global interdependence are increasingly involved in Zimbabwe. The country is no longer willing to remain at the end of the value chain, and business giants will take advantage of every opportunity to manage critical care routes. The future of world trade is shaped not only by supply and demand, but also by politics, politics and strategic foresight.