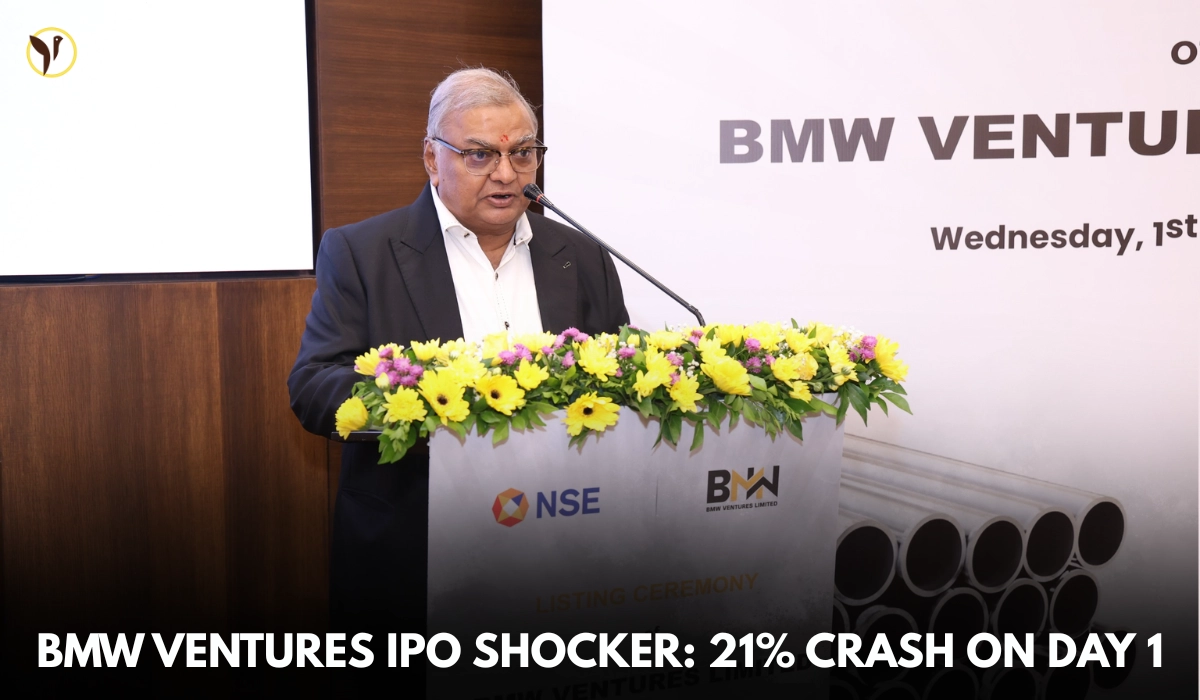

The debut of BMW Ventures on the Indian stock market has been disappointing, as it listed at a discount of 21% to the IPO issue price. The stock opened at ₹188 per share on the National Stock Exchange (NSE) versus the IPO price of ₹238 per share.

Experts in the market noted that, even with the hype leading into the IPO announcement, the weak listing is a reflection of high valuation concerns and caution in the sector. Many investors that entered at the price of ₹238 per share incurred an immediate loss, which diminished the ecosystem for other potential IPOs.

Why Did BMW Ventures Fall on Listing?

Several analysts pointed to why the IPO was weak at debut:

- Overvaluation: The IPO was priced at a higher band of ₹238.

- Market Fluctuation of Mid-caps and Small-cap: There was volatility in the space of mid-cap and small-cap stocks, and this may have added pressure.

- Sentiment: A soft subscription number suggests that retail investors are not trending as enthusiastically amongst analysts

According to data, subscribing to the IPO was moderate, and the Qualified Institutional Buyers (QIBs) were more interested than retail investors were.

BMW Ventures IPO & Listing Details

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This hard discount meant that investor wealth would have been lost, and some investors have begun to fret about whether this experience is indicative of the potential fate of an upcoming IPO.

Congratulations BMW Ventures Limited on getting listed on NSE today. BMW Ventures Limited is primarily engaged in trading/distribution of steel products, tractor engines and spare parts, manufacturing of PVC pipes and roll forming, and the fabrication of pre-engineered buildings… pic.twitter.com/tFvJeqb8HK

— NSE India (@NSEIndia) October 1, 2025

Post listing, although the deal was weak, some analysts believe there may be an opportunity for longer term investment if the company fulfills its respective plan in growth. BMW Ventures business model and position in the sector has potential upside, but it will be affected in the medium term by volatility.

Disclaimer: The information in this article is meant for informational purposes only. Jobaaj.com does not offer investment advice. Investors are advised to conduct their own due diligence and consult certified financial experts before making investment decisions.