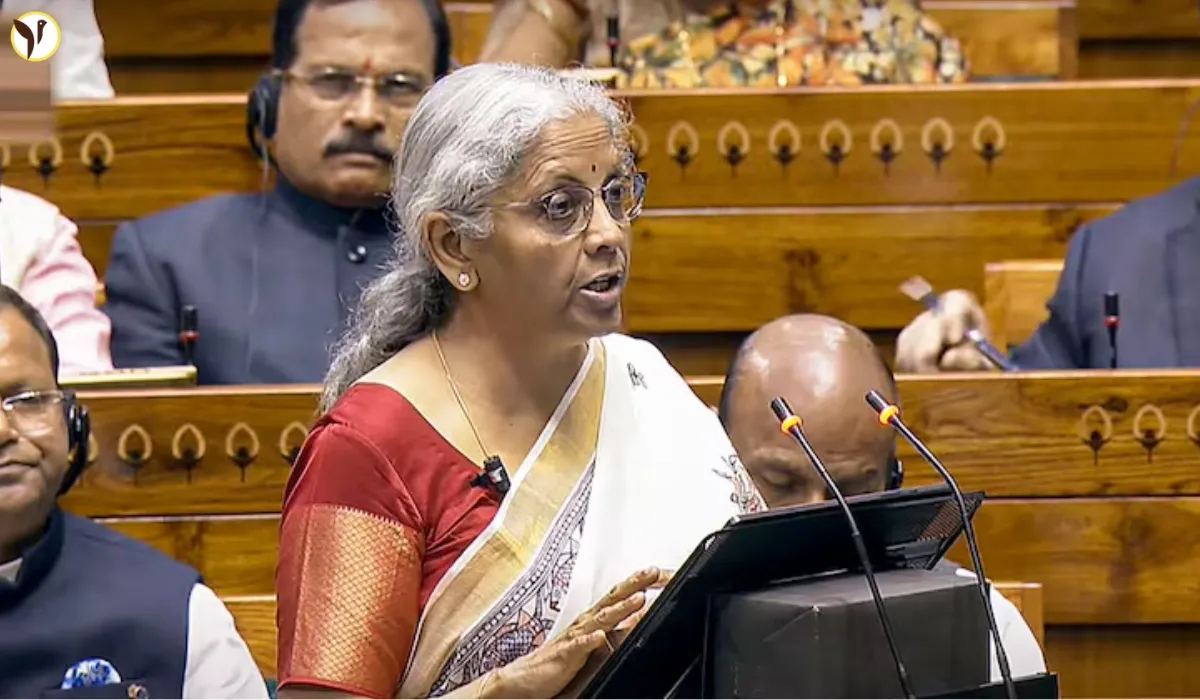

Reeves Backs Down on ISA Changes: £20,000 Limit Stays

So, you've probably heard the whispers – the government was *thinking* about messing with our ISAs. Specifically, the lovely tax-free £20,000 annual limit. And I'll admit, that got my attention, seeing as I’ve got a little tucked away myself! This article breaks down what happened with Rachel Reeves’s plans and what it means for your hard-earned cash.

The Great ISA Debate: What Was Proposed?

The initial idea, floated earlier this year, was to slash the maximum annual contribution to cash ISAs. Some suggestions went as low as £4,000! The reasoning? To encourage more people to invest in the stock market. Apparently, hundreds of billions are sitting untouched in cash ISAs, and the government wanted to see that money working harder.

The economic secretary, Emma Reynolds, even went so far as to call it a "failed investment culture." Ouch. A bit harsh, perhaps? But the idea was to create a better balance between cash savings and investments.

The Backlash

But then the banks and building societies stepped in. They weren’t too keen on this idea. For one thing, they rely on ISA savings to help fund mortgages. Cut the limit, and they'd have less to lend. Plus, most people simply prefer the security of cash. It’s understandable, investing in the stock market carries inherent risks.

And let's be honest, suddenly lowering your ISA allowance feels a bit like a kick in the teeth, especially during these challenging economic times.

Reeves's U-Turn: What Does It Mean?

In a recent interview, Rachel Reeves put a stop to the speculation. The £20,000 annual ISA allowance is safe… for now. She clarified that while she wants people to get better returns on their savings (and who doesn’t?), she's not going to force people into riskier investments by reducing the cash ISA limit.

So, breathe easy, fellow savers!

But... Is That It?

While the £20,000 limit remains, Reeves hasn't completely ruled out other changes to the ISA system. There's still talk of simplifying the different types of ISAs (cash, stocks and shares, etc.) and potentially merging them into one super-ISA. The government might also put a greater focus on financial advice.

Will it happen? We'll have to wait and see, likely through updates in the Autumn Budget or the Mansion House speech. This review could still result in some changes in the way ISAs operate.

| ISA Type | Current Annual Limit | Potential Future Changes |

|---|---|---|

| Cash ISA | £20,000 | Limit remains unchanged; potential simplification/merger |

| Stocks & Shares ISA | £20,000 | Potential simplification/merger; increased focus on financial advice |

| Lifetime ISA | £4,000 | Unlikely to be affected by this current review |

| Innovative Finance ISA | £20,000 | Unlikely to be affected by this current review |

What's Next?

Keep an eye out for the Autumn Budget. While the immediate threat to the £20,000 limit is gone, further ISA reforms are still a possibility. The government’s long-term aim is clearly to nudge more people toward investing in equities. However, it seems they're taking a gentler approach after the initial backlash.

It's a good reminder to us all to stay informed about our financial options. Whether you prefer the safe haven of a cash ISA or the potential higher returns of the stock market, understanding your choices is always key.